When you hear the word generic, you probably think of cheap pills that work just like the brand-name version. But when it comes to biologic drugs, that’s not the whole story. Biologics aren’t made in a lab like regular pills-they’re grown in living cells, making them incredibly complex. That’s why their copies aren’t called generics. They’re called biosimilars. And the cost difference between a brand biologic and its biosimilar isn’t just a little cheaper-it’s often more than half the price.

What’s the real price gap?

In 2025, the average 30-day prescription for a brand biologic cost $2,104. The biosimilar version? $919. That’s a 56% drop in price. For patients paying out of pocket, that means savings of nearly $1,200 per month. Multiply that by millions of people with conditions like rheumatoid arthritis, Crohn’s disease, or cancer, and you’re talking about billions in annual savings. Take Humira, the best-selling biologic in U.S. history. Before biosimilars arrived in 2023, a single year’s treatment cost about $80,000. Now, the same drug-thanks to biosimilars like Hyrimoz-costs as little as $16,000 a year for many patients. That’s an 80% discount. And it’s not just Humira. Almost every major biologic now has at least one biosimilar competitor, and prices keep falling as more enter the market.Why are biosimilars cheaper but not identical?

Traditional generics are exact chemical copies of small-molecule drugs. Biosimilars aren’t. Biologics are made from living organisms-yeast, bacteria, or animal cells. Even tiny changes in how they’re grown or processed can affect the final product. That’s why the FDA requires biosimilars to be “highly similar” with no clinically meaningful differences in safety or effectiveness. They don’t need to be identical. But they do need to work the same way. This complexity is also why biosimilars cost more to develop than regular generics. While a typical generic pill might cost $1 million to bring to market, a biosimilar can cost between $100 million and $250 million. That’s why there aren’t dozens of biosimilars for every brand biologic-yet.How much have biosimilars saved the system?

Since the first biosimilar was approved in 2015, the U.S. healthcare system has saved at least $36 billion, according to DrugPatentWatch. Other estimates, like those from the Department of Health and Human Services, put the total closer to $56 billion. Either way, it’s massive. In 2024 alone, biosimilars saved $12-20 billion. Here’s the kicker: biologics make up only 5% of all prescriptions in the U.S., but they account for over half-51%-of total drug spending. That’s why saving money here matters more than anywhere else. If you’re paying for insulin, a cancer drug, or a treatment for multiple sclerosis, you’re likely paying for a biologic. And if you’re paying full price, you’re paying more than you need to.

Why aren’t more people using biosimilars?

Despite the savings, only about 15-20% of biologic prescriptions are filled with biosimilars. That’s far below the 90% market share that regular generics hold. Why? One reason: patent thickets. Brand drug companies file dozens of overlapping patents to delay competition. Even after the original patent expires, they add new ones on delivery devices, dosing schedules, or manufacturing tweaks. These tactics can delay biosimilars for years. Another reason: rebate walls. Pharmacy Benefit Managers (PBMs)-the middlemen between insurers and drugmakers-get big rebates from brand biologic companies. Those rebates make it financially risky for insurers to switch to cheaper biosimilars. Even if a biosimilar is 70% cheaper, the PBM might still prefer the brand because it pockets a bigger cut. And then there’s confusion. Some doctors and patients still think biosimilars are “less effective” or “experimental.” But the FDA says they’re not. Every approved biosimilar has been tested in clinical trials and shown to work just like the original. In Europe, where biosimilars have been around longer, adoption rates are over 70%.What’s changing in 2025 and beyond?

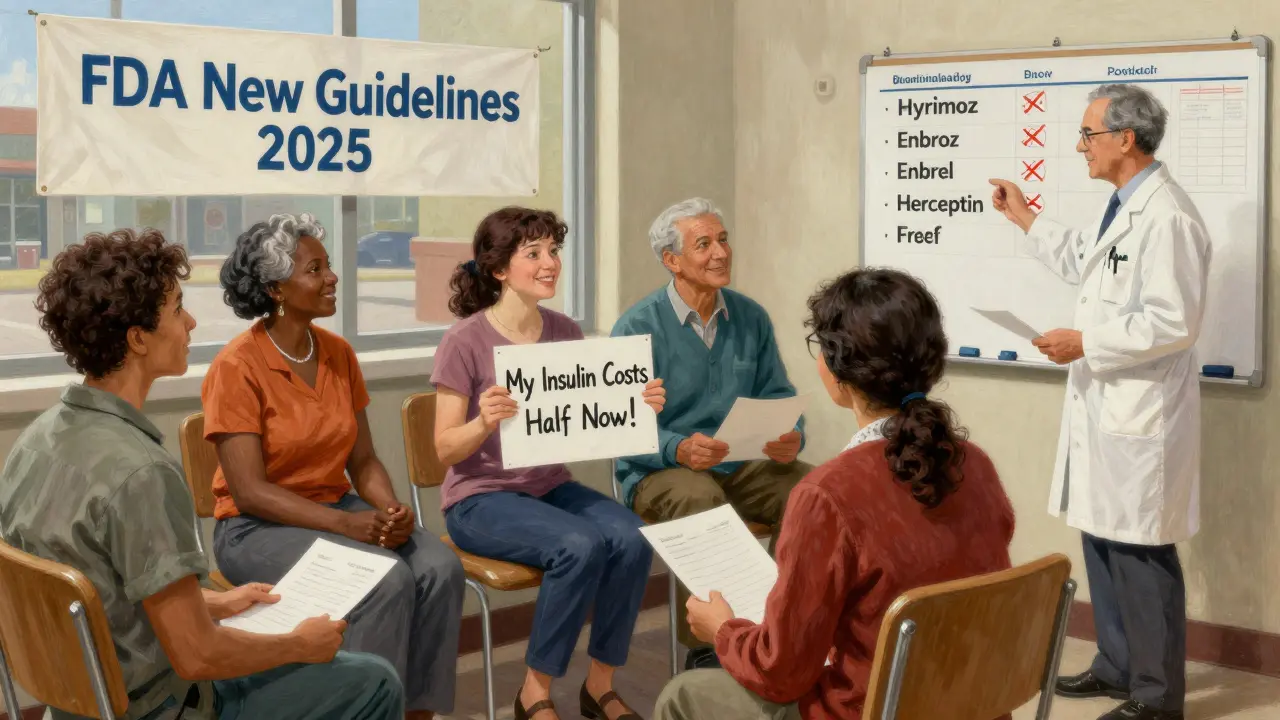

The FDA is making it easier and cheaper to develop biosimilars. In September 2025, they released new draft guidelines that reduce the need for repetitive clinical trials. That means more companies will enter the market, and prices will drop even further. The Biden administration’s Biosimilars Action Plan is pushing for changes in how Medicare and Medicaid reimburse these drugs. Right now, providers get paid the same for a biosimilar as a brand biologic, which disincentivizes switching. New rules aim to reward providers who choose lower-cost options. Industry analysts predict biosimilar market share will jump from 20% to 35-40% by 2030. That could mean over $125 billion in annual savings. For patients, that means fewer people skipping doses because they can’t afford their meds. For the system, it means less strain on budgets and more money for other care.

What does this mean for you?

If you’re taking a biologic drug right now, ask your doctor or pharmacist: Is there a biosimilar available? Is it covered by your insurance? If you’re paying cash, the savings could be life-changing. Some biosimilars are already priced at less than half the brand. For example:- Adalimumab (Humira) biosimilars: $16,000-$25,000/year vs. $80,000

- Etanercept (Enbrel) biosimilars: $18,000/year vs. $50,000

- Trastuzumab (Herceptin) biosimilars: $15,000-$20,000/year vs. $70,000

Dave Old-Wolf

8 January 2026I had no idea biosimilars could save so much money. My cousin takes Humira and was paying $6k a month out of pocket until she switched. Now it’s under $1.5k. Life-changing.

Still weird how the system makes you fight just to get cheaper meds.

Molly Silvernale

10 January 2026Oh, the beautiful chaos of American healthcare-where a molecule grown in yeast costs more than a used Prius, and the people who made it? They’re sipping champagne in a penthouse while you’re choosing between insulin and rent. Biosimilars? They’re not just cheaper-they’re a middle finger to profit-driven medicine. And yet… the system still bends over backward to protect the old guard. Hypocrisy has a patent number.

And don’t get me started on PBMs-they’re the vampires of the pharmacy chain, sucking blood from every dose.

Somebody’s making billions. It’s not you. It’s not me. It’s the guy who patented the word ‘biologic’ and called it innovation.

Ken Porter

10 January 2026Europe does it better. We’re falling behind because we let lawyers and lobbyists write drug policy. Fix the system or get left behind.

Luke Crump

11 January 2026They call them biosimilars like it’s some kind of compromise. But it’s not. It’s a lie. If it’s not identical, then it’s not the same. They’re playing games with our lives under the guise of science. And you know what? The FDA doesn’t care. They’re just signing papers while patients die waiting for affordable care. This isn’t progress-it’s corporate theater with a lab coat.

Manish Kumar

12 January 2026Actually, in India we have biosimilars for everything-Humira, Herceptin, even the expensive cancer stuff. Cost? Like 10% of US price. No joke. My uncle got treated for rheumatoid arthritis with a biosimilar for $300 a year. Here in US, same drug costs more than my entire annual salary. Why? Because the system is rigged. Big Pharma owns Congress, owns the FDA, owns the insurance companies. It’s not about science, it’s about control. And the worst part? People think it’s normal. We’ve been conditioned to accept being robbed. We need a revolution, not a guideline change.

Aubrey Mallory

13 January 2026For anyone reading this and thinking ‘I don’t qualify’-you do. Ask your doctor. Ask your pharmacist. Ask your insurance. Don’t wait for them to tell you. Push. You’re not asking for a favor-you’re claiming what’s owed to you. And if they say no, ask again. And again. Your life isn’t negotiable.

Donny Airlangga

15 January 2026Biggest thing I didn’t realize: biosimilars aren’t just cheaper-they’re just as safe. I was scared to switch from Enbrel, but my rheumatologist showed me the studies. No difference in flare-ups, no extra side effects. Now I’m saving $32k a year. Why wasn’t this explained to me before? Because nobody wants you to know how easy it is to save money here.

Joanna Brancewicz

16 January 2026Reimbursement parity is the key bottleneck. Providers get paid the same for biosimilars, so they default to brand. No incentive to switch. Fix the payment model, and adoption skyrockets.

Evan Smith

17 January 2026So let me get this straight… we spent $56 billion on biosimilars savings, and the system still makes you beg for a cheaper version of your life-saving drug? Cool. Cool cool cool. Meanwhile, my cousin’s insurance still won’t cover the biosimilar unless she fills out 17 forms and waits 6 weeks. Thanks, America. You’re doing great.