When you walk into a pharmacy and find your prescription unavailable, or your doctor tells you a critical drug has been delayed, it’s not just bad luck. It’s the result of pricing pressure and shortages - two forces that have reshaped healthcare economics since 2020. These aren’t temporary hiccups. They’re structural shifts that are still affecting how much you pay, how long you wait, and whether you even get the treatment you need.

Why Healthcare Items Are Vanishing

In 2021, hospitals across the U.S. reported shortages of over 100 essential medications, including antibiotics, anesthetics, and insulin. The World Health Organization confirmed that more than 50 countries faced critical drug shortages during the peak of supply chain chaos. This wasn’t random. It was the result of three overlapping problems: disrupted manufacturing, labor shortages in production facilities, and sudden spikes in demand. Take antibiotics, for example. About 70% of the world’s active pharmaceutical ingredients (APIs) are made in just two countries: India and China. When lockdowns hit China in early 2022, and India restricted exports to protect its own supply, production lines stalled. By mid-2022, the U.S. saw a 40% drop in the monthly shipment of key antibiotics. Hospitals had to ration doses. Patients waited weeks for replacements. Meanwhile, demand didn’t drop. In fact, it rose. Post-pandemic, chronic illness diagnoses surged. People delayed care during lockdowns, then flooded clinics once restrictions lifted. The result? A perfect storm. Fewer inputs. More demand. Prices shot up.How Pricing Pressure Works in Health Markets

Pricing pressure isn’t just about companies raising prices. It’s about markets breaking. When supply can’t keep up, prices should rise to balance demand. But in healthcare, that doesn’t always happen - because of regulations, insurance contracts, and price caps. In the UK, the government set a cap on energy prices in 2021. It was meant to protect households. But it had a side effect: energy-intensive drug manufacturers couldn’t cover rising electricity and gas costs. Between August and December 2021, 27 small pharmaceutical suppliers went bankrupt. That didn’t just hurt their workers - it cut supply chains. A single plant shutdown can remove 15% of a drug’s global supply. In the U.S., Medicare and Medicaid set fixed reimbursement rates. If a drug’s cost jumps 30%, but the government won’t pay more, providers face a choice: absorb the loss, reduce inventory, or stop offering the drug. Many chose the last option. A 2023 study from the American Journal of Managed Care found that 18% of hospitals stopped stocking at least one essential drug because of cost pressures. This isn’t about greed. It’s about broken incentives. When prices can’t rise to reflect reality, scarcity follows. And when scarcity hits, people panic-buy. Pharmacies report spikes in early refills - sometimes 3x the normal volume - because patients fear running out. That makes shortages worse.Who Pays the Real Cost?

The most visible cost is higher prices. But the hidden costs are worse. Patients delay care. A 2022 survey by the Kaiser Family Foundation found that 34% of Americans skipped a recommended treatment because of cost or availability. That’s 1 in 3. For diabetics, skipping insulin for even a few days can mean emergency hospitalization. For cancer patients, missing a chemotherapy window can reduce survival chances by 15%. Health systems pay too. Hospitals spent an extra $12 billion in 2022 just to secure alternative suppliers or pay premium shipping fees. The Cleveland Federal Reserve estimated that supply shocks in healthcare raised core medical inflation by 0.3% in 2022 - nearly triple the effect of general goods inflation. That’s not a small number. It’s enough to push entire insurance premiums higher. Employers feel it. Companies with self-insured health plans saw claims rise 18% in 2022. Many raised employee contributions or cut coverage. Small businesses, especially, couldn’t absorb the shock. A 2023 survey by the National Federation of Independent Business showed that 41% of small employers reduced or eliminated health benefits due to rising drug and supply costs.

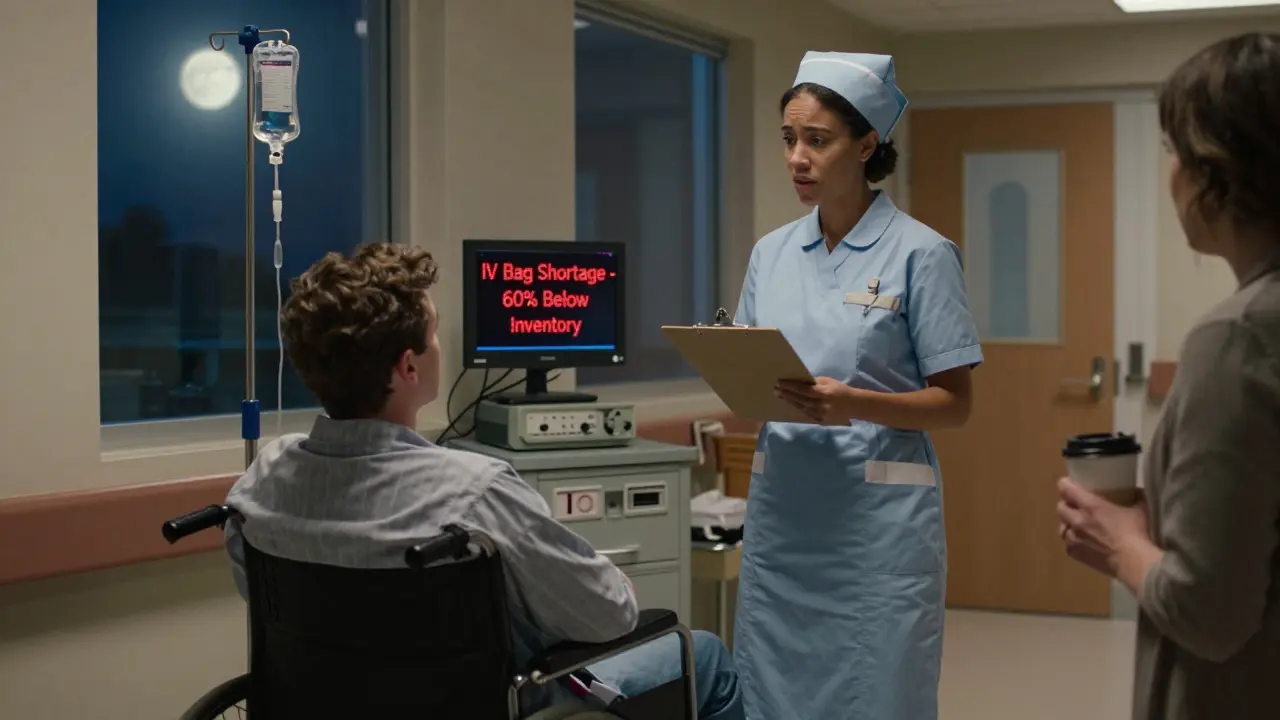

Supply Chain Shortfalls That Hit Close to Home

It’s not just pills and syringes. Think about the simple things: IV bags, catheters, glucose test strips. These are low-cost items - but they’re made in high-volume factories with thin margins. When energy prices spike, or shipping containers back up at ports, these items vanish first. In 2022, the U.S. saw a 60% increase in shortages of IV fluid bags. Why? The main manufacturer, a company in Puerto Rico, lost power during Hurricane Fiona. The backup plant in Germany was already running at 110% capacity. No one had spare capacity. No one had a plan B. The same thing happened with insulin pens. A single factory in Germany, responsible for 30% of global supply, had to shut down for 11 weeks due to labor shortages. The result? A 22% price increase in the U.S. and a 3-month wait for patients in rural areas. Even medical devices like ventilators and dialysis machines faced delays. The global supply chain pressure index for medical equipment peaked at 4.1 in December 2021 - more than 25 times its pre-pandemic level. Hospitals postponed elective surgeries. Patients waited. Some died waiting.What’s Being Done - and What’s Not Working

Governments tried to fix this. The U.S. passed the Drug Supply Chain Security Act in 2023, requiring better tracking of drug shipments. The European Union launched a €1.8 billion fund to rebuild API production on its soil. But these are long-term fixes. They won’t help today’s patients. Some companies are adapting. Pfizer and Novo Nordisk now maintain dual-sourcing for 80% of their critical inputs. That means two suppliers for every key ingredient. It costs more - but it cuts risk. Companies using this strategy saw 35% fewer disruptions in 2023. Digital tools are helping too. Hospitals using AI-powered inventory systems reduced stockouts by 28%. They can now predict shortages weeks in advance, based on global shipping data, weather patterns, and production reports. But the biggest problem remains: rigid systems. Insurance companies still pay fixed rates. Regulators still cap prices. Manufacturers still rely on single-source suppliers. Until these structures change, shortages will keep coming - and prices will keep rising.The Future Won’t Be Calmer

The San Francisco Federal Reserve says global supply chain pressure has returned to pre-pandemic levels. But that’s misleading. The baseline has shifted. Climate events, geopolitical conflicts, and labor shortages aren’t going away. The World Bank estimates that climate-related disruptions will increase medical supply delays by 15-20% annually through 2030. Nearshoring - moving production closer to home - sounds smart. But it’s expensive. Making insulin in Ohio instead of India raises production costs by 40%. That cost gets passed on. Patients will pay more. Or they’ll go without. The truth is, we’ve seen this before. In the 1970s oil crisis, gas lines formed because prices were capped. People hoarded. Gas stations ran dry. The same thing is happening with medicine. When you prevent prices from adjusting, you don’t stop inflation - you just make shortages worse.What You Can Do

You can’t fix global supply chains. But you can protect yourself. - Ask your doctor about alternatives. If your drug is on shortage, there’s often a generic or similar medication that works just as well. - Use mail-order pharmacies. They often have better inventory than local stores. - Don’t stockpile. Buying extra doses doesn’t help. It makes shortages worse for others. - Track your prescriptions. Use apps like GoodRx or your insurer’s portal to see real-time availability. - Advocate. Tell your representatives that healthcare supply chains need investment, not just price controls. This isn’t about politics. It’s about survival. Medicines aren’t commodities. They’re lifelines. And when the system breaks, the people who suffer first are the ones who need them most.Why do drug shortages happen even when demand is steady?

Drug shortages often stem from supply-side failures - not demand spikes. Most medications rely on a handful of global factories for active ingredients. If one plant shuts down due to labor strikes, power outages, or regulatory issues, supply can drop by 30-50% overnight. With no backup suppliers, even steady demand leads to shortages. For example, in 2022, a single fire at a German insulin pen factory cut global supply by 30%, triggering shortages across North America and Europe.

Can price controls prevent higher drug costs?

Price controls often make shortages worse. When prices are capped below market levels, manufacturers lose incentive to produce or invest in new supply. In the UK, energy price caps in 2021 led to 27 small pharmaceutical suppliers going bankrupt because they couldn’t cover rising production costs. The result? More drug shortages, not fewer. Markets need price signals to balance supply and demand - without them, scarcity follows.

Are generic drugs less affected by shortages?

No - generics are often more vulnerable. Because they’re sold at low margins, manufacturers rarely invest in backup production lines or diversified suppliers. In 2022, 62% of all U.S. drug shortages were for generic medications, including antibiotics, insulin, and heart medications. These drugs make up 90% of prescriptions but only 20% of spending - so they’re the first to be cut when costs rise.

How do supply chain issues affect rural healthcare?

Rural areas suffer most. They rely on fewer distributors and have less inventory buffer. When shipments are delayed, local pharmacies can’t get replacements for weeks. A 2023 study in the Journal of Rural Health found that rural patients waited 22 days longer on average for critical medications than urban patients. In some cases, patients had to drive over 100 miles to fill prescriptions - and many couldn’t.

Is nearshoring a real solution to drug shortages?

Nearshoring helps, but it’s not a quick fix. Moving drug production to the U.S. or Europe reduces shipping delays and geopolitical risk. But it increases costs by 30-40%. That means higher prices for patients and insurers. The U.S. government is investing billions to rebuild domestic API capacity, but full production won’t resume until 2027-2028. In the meantime, shortages will continue.